The new year opened with a familiar but closely watched event in the XRP ecosystem as Ripple released 1 billion XRP from escrow on January 1, 2026. The unlock arrived at a sensitive moment for price action, coming just after XRP closed December 2025 in the red.

Large escrow releases often lead to concerns about sell pressure, but early on-chain activity suggests the usual Ripple pattern is already unfolding, with a significant portion of the unlocked supply being prepared for relocking.

How The 1 Billion XRP Escrow Release Unfolded

Blockchain data shows the release occurred in three major transactions, all settled within a narrow time window on January 1. Immediately the year started, 300 million XRP, valued at about $552 million, was unlocked and sent to the address rMhkqz, identified as the Ripple (28) wallet. Shortly after, another 200 million XRP, worth about $368 million, followed into the same wallet, bringing Ripple (28)’s intake to half a billion XRP within seconds.

The final and largest portion arrived into a third wallet during which 500 million XRP, valued at approximately $920 million, was released to the r9NpyV address, designated as the Ripple (9) wallet. Together, these transactions completed the scheduled 1 billion XRP escrow release, immediately increasing the circulating supply on paper.

The timing of the escrow release adds complexity to XRP’s near-term outlook. XRP ended December 2025 with a red monthly close of negative 14.8%. Notably, this was the first time XRP closed December in the red since 2022. An influx of unlocked tokens during such a period can increase bearish sentiment, particularly among short-term traders sensitive to supply changes.

Relocking Activity As Ripple Repeats Its Playbook

History shows Ripple always relocks between 70% and 80% of each monthly escrow release, a practice that has helped soften long-term supply shocks. Interestingly, activity after the unlocks indicates this approach was repeated within 24 hours of the unlocks. Transaction records from XRPScan reveal that funds exiting the Ripple (9) wallet were quickly routed toward new escrow arrangements, and a substantial share of the newly released supply was removed from immediate circulation.

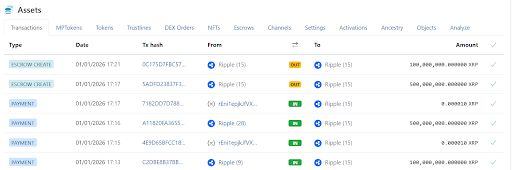

Millions of tokens were sent out from both Ripple (9) and Ripple (28) simultaneously. At 17:17 UTC, an escrow creation transaction locked 500 million XRP into the Ripple (15) address, followed by another escrow creation at 17:21 UTC that secured an additional 100 million XRP in the same wallet.

Related Reading: Ripple’s XRP Ledger Just Did Something Bitcoin Has Never Done

Parallel activity was also observed from Ripple (14), where a separate escrow creation locked 100 million XRP at 17:19 UTC. Combined, these transactions accounted for 700 million XRP already placed back into escrow.

The appearance of escrow creation transactions changes the narrative of a supply dump. Instead of a full-scale sell-off, the data points to controlled relocking consistent with Ripple’s strategy of escrow management. XRP’s price response will likely depend less on the headline escrow release itself and more on how much of the remaining unlocked supply reaches crypto exchanges.